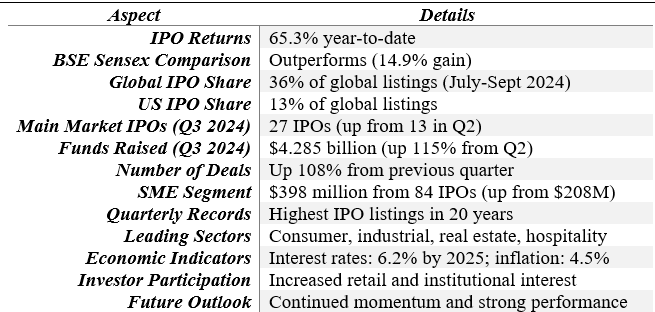

In an impressive turn of events, India’s primary market recorded 111 IPOs in the third quarter of 2024, marking its highest activity in twenty years. This surge has allowed India to seize a remarkable 36% share of global IPO listings during this period, according to a report by EY

The Indian IPO market overview:

Table of Contents

Indian IPO Market Outperforms Global Peers

India’s Recent reports highlight a strong performance in the Indian IPO market, with returns reaching an impressive 65.3% year-to-date. This marks a significant outperformance compared to the BSE Sensex, which recorded a gain of only 14.9% during the same period, according to EY India.

Dominance in Global IPO Listings

India has taken a commanding lead in the global IPO landscape, capturing 36% of total listings between July and September 2024. This figure significantly surpasses the United States, which accounted for just 13% of global IPO activity. Such statistics showcase India’s growing influence and attractiveness as a destination for companies looking to go public.

Surge in IPO Activity

In the third quarter of 2024, India saw 27 IPOs in its main market, compared to just 13 in the previous quarter. The total amount raised soared to $4.285 billion, a remarkable increase from $1.992 billion in Q2 2024. This represents a 115% rise in funds raised and a 108% increase in the number of deals.

Additionally, the SME segment also demonstrated strong performance, raising $398 million from 84 IPOs, up from $208 million in 60 IPOs in the previous quarter. This surge signifies a robust interest in smaller enterprises as well.

Record Listings and Investor Confidence

The Indian stock exchanges are experiencing their highest quarterly IPO listings in two decades. This trend reflects the increasing maturity of India’s capital markets and growing investor confidence. Prashant Singhal, India Markets Leader at EY India, noted that both domestic and international investors are actively participating, solidifying India’s status as a preferred market for public offerings.

Leading Sectors for IPOs

The consumer retail, diversified industrial, real estate, hospitality, and construction sectors are driving the majority of IPO activity in both the main and SME markets. These sectors are benefiting from a favourable macroeconomic environment, with interest rates projected to moderate to 6.2% by 2025 and inflation forecasted at 4.5%.

Future Outlook

Looking ahead, the increase in IPO filings combined with strong secondary market performance suggests that India’s IPO market momentum is likely to continue. The combination of favorable economic conditions and high investor interest creates a promising landscape for future public offerings.

Conclusion

Overall, India’s IPO market is thriving and poised for further growth. The significant increase in listings and funds raised demonstrates strong investor confidence and a robust economic environment. As more companies look to enter the public market, India is well-positioned to maintain its leadership in global IPO activity. In my opinion, this trend is a positive indicator for the Indian economy, reflecting both stability and opportunity for investors and companies alike. When investors are eager to buy shares in new companies, it usually means they believe those companies will do well in the future. Several factors that are driving this optimism includes:

- Strong Returns: Investors are seeing high returns from IPOs, which makes them more likely to invest in new offerings.

- Growing Market: India is becoming a major player in the global IPO scene. With 36% of new listings, it’s clear that many companies want to go public here instead of in other countries like the U.S.

- Diverse Opportunities: A variety of sectors—like technology, real estate, and consumer goods—are entering the IPO space. This variety gives investors more choices, which is always a good thing.

- Economic Stability: With interest rates expected to stabilize and inflation projected to remain manageable, the economic environment is favorable for businesses looking to raise money through IPOs.

- Investor Confidence: More retail and institutional investors are jumping into the market, which boosts overall market confidence and liquidity.

In simple terms, the Indian IPO market is thriving, and it looks like this trend will continue. This is great news not only for investors but also for companies that need funds to grow and innovate. As India becomes a more attractive place for new businesses to launch, it creates more job opportunities and helps the economy as a whole. Overall, the future looks bright for India’s IPO landscape!